NEWS

Diamond doyen Arun Mehta passes away!

Diamond

Industry & trade tycoon Arunkumar Ramniklal Mehta born in January 1940

passed away on June 14 in Mumbai. A man of inspiration lived up his life as ‘a

simple living & sparkling thinking’ throughout the life! One of the mammoth

personalities Arunbhai earned much of respect & honour than what he earned

from his business in the life!

Throughout

his life he inspired numbers of new entrant diamantaires by facilitating

adequate guidance! In general he insists upon to go for needed diamond

education, manage proper capital upon commencement and to develop a leadership

quality to lead a team! These were the brilliant guidance for new entrant! He

was convinced that, established diamantaire must provide a space for new

generation that may add more sparkle in the business India!

GST Trade facilitation Measures announced

Recommendations

of GST council

Related

to Law & Procedure!

The

40th GST Council met under the Chairmanship of Union Finance & Corporate

Affairs Minister Smt Nirmala Sitharaman through video conferencing. The meeting

was also attended by Union Minister of State for Finance & Corporate

Affairs Shri Anurag Thakur besides Finance Ministers of States & UTs and

senior officers of the Ministry of Finance& States/ UTs.

The

GST Council has made the following recommendations on Law & Procedures

changes. Measures for Trade

facilitation are,

1: Reduction

in Late Fee for past Returns:

As a

measure to clean up pendency in return filing, late fee for non-furnishing FORM

GSTR-3B for the tax period from July, 2017 to January, 2020 has been reduced /

waived as under: -

Alrosa January-May sales reach to $959.9mn

In

May 2020, Alrosa Group sold $40.1 million worth of rough and polished diamonds.

The revenue from rough diamond sales sequentially grew to $36.2 million and

from polished diamond sales −to $3.9 million.

Alrosa’s

total rough and polished diamond sales in January–May 2020 amounted to $959.9

million, including rough diamonds sales of $930.6 million, polished diamonds of

$29.3 million.

Sodiam lowers cost hikes tax payment!

Sodiam,

the National Diamond Trading Company of Angola recorded a net profit of US$27,1

million in 2019, despite the worldwide decline registered in the diamond

market. Sodiam underlines that last year the company saw its operating costs

drop by 17%, maintaining the trend started in 2018, while its tax contribution

increased by around 21%.

The

company's management considers that the financial year was positive, because it

ensured good results for Sodiam and for the State shareholder, although it

continues to manage the effects of a difficult business environment.

DGCX listed in ESMA transparency

The

European Securities and Markets Authority has added DGCX to list of

Third-country

trading venues that meet post-trade transparency requirements

The

Dubai Gold and Commodities Exchange (DGCX) announced that it has received a

positive assessment from the European Securities and Markets Authority (ESMA),

the EU’s securities markets regulator, and is now listed as a third-country

trading venue (TCTV) that meets the post-trade transparency requirements under

MiFID II and MiFIR.

Granada had mined over 164K Oz of silver!

Granada

Gold Mine updates its 2020 plans and activities aimed at exploration and bulk

sampling with the related highlights. Diamond drilling aims to focus on the

high-grade Vein No 1 structure. To date,

the structure has been traced for 500 metres on surface.

Historic

underground production between 1930 and 1935, from 2 shafts had an average

grade of 9.7 grams /tonne gold and 1.5 grams/tonne silver from 164,816 tonnes

of mineralized material (51,476 ounces gold in 181,744 tons at 0.28 oz/ton)

primarily from Vein No.2 underground.

World's first! A UFO-shaped legal tender!

According

to the Royal Canadian Mint, after the technological breakthroughs in rocketry

during WWII, the eyes of many were pointed to the sky in search of an

unidentified flying object (UFO). There were so many sightings that the US Air

Force launched a series of formal investigations beginning with Project Sign in

1948 and culminating in the largest ever government investigation of UFOs,

Project Blue Book, which ended in 1969.

Gold relevance increased at Central Banks!

Central

banks remain positive on gold amid COVID-19 risks said Shaokai Fan, Director,

Central Banks and Public Policy, WGC. Our central banks team, in partnership

with Yougov, recently concluded the 2020 Central Bank Gold Reserves Survey.

This

year’s survey, which saw a jump in the number of responses, shows strong signs

of an increase in gold’s relevance for central bank reserve management: 20% of

respondents say that they plan to add gold to their reserves this year, up from

8% in the 2019 survey. The results also indicate shifts in investment attitudes

towards gold as the impact of the COVID-19 pandemic continues to affect the

global financial and economic outlook.

Realignment of Foreign Trade supply chains!

Inked

on, Global Supply Chains & Foreign Trade in a Post-COVID Paradigm by

Arindam Som, India Ratings and Research (Ind-Ra) believes that the COVID-19

pandemic will stoke a global policy narrative around the realignment of

cross-border supply chains particularly for the pivotal role played by the

Chinese economy. However, this realignment will take time to gain momentum.

The

ability of other emerging markets – including India – to benefit from a shift

away from China will be driven by two factors – first, the ability of these

markets to provide cost-competitive alternatives and second and the evolution

of the trade policy in various importing nations.

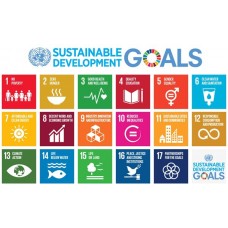

RJC to host UN session on SDG Impact

Register

for the session on June 15, 2020 of UN

Global Compact Leaders’ Summit using RJC's code: VLS2020_RJC at: 13:00 - 14:00

(EDT)

RJC

to host a deep dive session at the UN Global Compact Leaders’ Summit, SDG Impact

through the Jewellery Industry on June 15, 2020 at, 13:00 - 14:00 (EDT). Register

for the session and UN Global Compact Leaders’ Summit using RJC's complimentary

code: VLS2020_RJC.