NEWS

New Lecture Series of GIA in NY!

GIA

(Gemological Institute of America) presents a dynamic and informative series of

talks, GIA New York Science Talks Series, where GIA researchers will share

ground-breaking discoveries related to gemology – including natural diamond

formation, what diamonds tell us about Earth’s deep mantle, laboratory-grown

diamonds and more.

The

quarterly talks are free and open to the public. For more information and to

register for the first talk is scheduled on October 30, visit GIA website. GIA

New York Science Talks Series gives guests the opportunity to learn about

cutting edge developments in gemological research and ask questions of leading

researchers.

Five Grand New Showrooms opens!

Reliance

Jewels, one of India’s most trusted jewellery brands, has launched five new

grand showrooms in Delhi, Mathura, Meerut, Gorakhpur & Moradabad. As

Festive season is here, the swanky new showrooms will showcase the new

hand-crafted special collection, Atulyaa.

This

collection consists of statement necklace sets in 22Kt gold in Antique

&Culcatti finish along with 18Kt Gold & Diamond studded sets. The

Collection includes chokers, small & long style necklaces which are sure to

sparkle this festive season.

Yug open new store!

Vishwa

Gold a distributor of Yug by Tanvi Gold Cast from Ahmedabad launched gold

jewellery with Swarovski Zirconia at their new store cum office at Ahmedabad. The

Chief Guest for the occasion was Mr. Rajendra Jain, Managing Director Swarovski

Gemstones India, Mr. Bipin Viradiya Founder Director Yug by Tanvi Gold Cast,

Mr. Raj Bhalara Director Yug by Tanvi Gold Cast, Mr. Brijesh Amin & Mr.

Umesh Patel Directors of Vishwa Gold along with reputed and respected industry

dignitaries and media of Gujarat.

KYC and supply source traceability

The

World Federation of Diamond Bourses (WFDB) Presidents Meeting after a special

session on blockchain technology and supply source traceability has decided to

take further steps on the need for increased transparency in diamond

transactions.

The

decision came after a debate on the conclusions of a panel on traceability,

provenance and blockchain technology which included De Beers Group's Feriel Zerouki,

NAMDIA's Kennedy Hemutenya, London Diamond Bourse President Alan Cohen,

Alrosa's Head of International Relations Peter Karachiev, James Bernard,

Director of Sales for the DMCC and Iris Van Der Veken, Executive Director of

the Responsible Jewellery Council moderated by Peter Meeus, Honorary Chairman

of the Dubai Diamond Exchange.

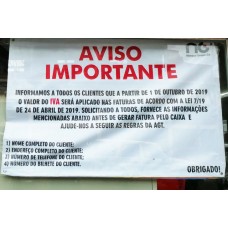

Angola, a VAT country from Today

As

from this Tuesday, October 1, 2019 Angola will be included in the list of

countries in the SADC region that charge the Value Added Tax (VAT), which will

replace the Consumption Tax. The Value Added Tax, which is levied on goods and

services produced internally or imported, will have a flat rate of 14%.

This

tax was to be implemented on July first of the current year, but national

entrepreneurs asked for an extension of the deadline because they were not

properly prepared. In the 2019 reviewed General State Budget that was approved

in June by the National Assembly, the prevision on the cash income of the VAT

to be collected had been revised upwards by 60 percent, in other words, the

figures before were 156.3 billion kwanzas and moved to Akz 249.3 billion.

China proposes to set aside for bad loans

China’s

Finance Ministry has proposed a new rule that would cap the amount banks have

to set aside for bad loans, a move that could boost dividends to shareholders

but weaken banks' capabilities to absorb losses in the future, said the Media

China.

Under

the proposal, loan loss provisions for Chinese banks would be limited to no

more than double the minimum regulatory requirement, with any funds left over

booked as profit, according a new draft of financial institution accounting

rules published on September 31.

De Beers appoints Alastair Bickerstaff

De

Beers Group Auctions is pleased to announce the appointment of Alastair

Bickerstaff as the Head of Product Development and Sales. The new role, which

was created following the departure of the Head of Sales and CRM, is an

amalgamation of two instrumental elements of the business – Product Development

and Sales.

As

the Head of Product Development and Sales, Alastair’s aim is to develop more

synergy between the two functions and better address our customers ‘product

needs.

Richemont and Alibaba Launches Net-A-Porter

Richemont

and Alibaba Group announce the opening of the Net-A-Porter flagship store on

Alibaba’s Tmall Luxury Pavilion, an exclusive platform dedicated to the world’s

leading luxury and fashion brands.

The launch

marks the beginning of operations of the joint venture established between Yoox

Net-A-Porter Group, the world’s leading online luxury and fashion retailer, and

Alibaba Group, the world’s largest online and retail commerce company by gross

merchandise volume. The Net-A-Porter flagship store’s grand launch campaign

will begin in the second week of October, after China’s Golden Week.

Australian Lunar Series III 2020 coin

The

first coloured release in the Australian Lunar Series III from Australian Mint,

this 1oz silver coin showcases the 2020 Year of the Mouse design in vivid

colour. Showcasing an endearing design of mice foraging on husks of corn, this

flawless silver proof quality coin would make the perfect keepsake for those

born in the Year of the Mouse in 2020, 2008, 1996, 1984, 1972, 1960 and 1948.

Credit Neutral for Corporates initiatives!

Arindam

Som, Analyst-India Ratings and Research Pvt Ltd (Ind-Ra) believes the reduction

in corporate tax rates is unlikely to materially impact the credit profile of

India corporates, although the risk of fiscal slippage is likely to increase

significantly.

Ind-Ra’s

analysis of the top 1,000 listed corporates by revenue indicates that the total

quantum of reduction in tax liability in FY20 is likely to range between INR600

billion and INR650 billion. Of this, 50%-60% of the benefit is likely to accrue

to corporates with relatively healthy credit profile marked by low leverage and

comfortable interest coverage.