Positive report for Karowe Underground

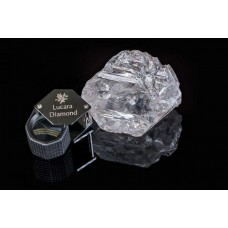

Lucara Diamond announces the results of a positive underground Feasibility Study to expand its 100% owned Karowe diamond mine, one of the world's most prolific producers of large, high value type IIA diamonds and the only diamond mine in recorded history to have produced two +1000 carat diamonds.

The underground expansion at Karowe is expected to double the mine life, and generate significant revenue and cash flow out to 2040, extending benefits to the Company, its employees, shareholders, communities surrounding the mine, and Botswana.

Combined Open Pit & Underground Economic Highlights are, LOM production of 7.8 million carats out to 2040; resource remains open to depth, $5.25 billion in Gross Revenue, Pre-production capital costs of $514 million for the underground project, After-tax undiscounted net cash flow of $1,220 million and no real diamond price escalation. After-tax NPV (5%) of $718 million, Payback Period of 2.8 years extending the mine life 15 years (including stockpiles) & Average LOM operation costs of $28.43 per tonne of ore processed.

Eira Thomas, President and CEO commented: "Lucara is highly encouraged by the results of the Karowe Underground feasibility study which has outlined a much larger economic opportunity than first envisaged in the 2017 PEA and represents an exciting, world class growth project for our Company.

Diamond deposits are rare and getting rarer. In this context, we are extending a mine that is in a class of its own, having produced 15 diamonds in excess of 300 carats, including 2 greater than 1000 carats in just seven years of production. Further, we have sold ten diamonds for in excess of $10 million each, including the record-setting 813 carat Constellation which sold for $63.1 million.

A significant portion of the cost to expand our mine underground can be funded from cash flow, and the investment is expected to be paid back in less than 3 years, as the underground allows us to exploit the highest value part of the ore body first and generate more than $5.25 billion in gross revenue.

What's more, margins remain healthy despite the application of conservative diamond pricing models that reflect the current, difficult market environment. Lucara's short term view is that the market is now stabilizing. Longer term, the fundamentals are expected to strengthen in line with supply shortfalls from mature, depleting mines in Australia and Canada. It is important to note that a return to diamond prices observed in 2015 would nearly double the NPV (5%) of this project to $1.4 billion."