Angola, a VAT country from Today

As from this Tuesday, October 1, 2019 Angola will be included in the list of countries in the SADC region that charge the Value Added Tax (VAT), which will replace the Consumption Tax. The Value Added Tax, which is levied on goods and services produced internally or imported, will have a flat rate of 14%.

This tax was to be implemented on July first of the current year, but national entrepreneurs asked for an extension of the deadline because they were not properly prepared. In the 2019 reviewed General State Budget that was approved in June by the National Assembly, the prevision on the cash income of the VAT to be collected had been revised upwards by 60 percent, in other words, the figures before were 156.3 billion kwanzas and moved to Akz 249.3 billion.

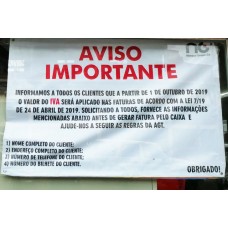

In this first stage, a total of 1,600 companies, registered with the Tax Office as Large Taxpayers and others that have voluntarily adhered to the general regime are the first ones to be levied such tax. To Adilson Sequeira, coordinator of the VAT implementation technical group, “there is no intention of the Angolan executive to back down. It is really going to go ahead, which is on October 1st”, assuring that the conditions are in place for its implementation.

Thus, he said, as of October 1, the authorized companies will start charging VAT, and invoices must have entered the tax rate using systems duly validated by the General Tax Administration (AGT). Adilson Sequeira also advised that companies are forbidden to charge VAT through systems that aren’t licensed by the AGT.

Companies that opted for the general VAT regime now need to submit a periodic declaration or report that will be controlled by the AGT. From January 2020 onwards, they will start submitting electronic invoices, which will be controlled in detail in terms of monitoring the collection of this tax.

Improper collection is prohibited under the VAT Code. Those who have not adhered to the general regime cannot charge VAT, he warned, adding that the amount improperly charged will be returned to the final customer. In the year 2021, all taxpayers with an annual turnover or operation equivalent in Kwanza to USD250,000 will be included in this new model of taxation.

VAT, among other advantages, provides for reducing the tax burden, eliminating the consumption tax and companies in this general regime will no longer suffer double taxation, in addition to the organization of accounting systems.