Forex provide ample cover of imports!

Recently Economic growth jumped to 8.2% YoY in Q2, highest level since early 2016, proves, India is feeling the heat from emerging markets EM turmoil, but is no Turkey or Argentina! Q1 proves, India’s foreign exchange reserves still provide ample cover of imports, says Arjen van Dijkhuizen, Sr. Economist, ABN AMRO. His India Watch said, ‘Growth jumps to 2-year high despite market turmoil!

Higher oil prices have driven external deficits up, but external / public debt ratios manageable, FX reserves still comfortable, higher core inflation and rupee weakness have triggered two RBI rate hikes! Parliamentary elections in spring 2019 litmus test for Modi, Further clean-up of banking sector needed!

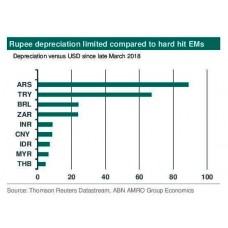

Over the past months, Ems have been hit by a general risk aversion, driven by ongoing Fed rate hikes and general US dollar strength, an escalating trade conflict between the US and China and a weakening of the Chinese Yuan. These generic factors have affected a large number of EMs, although with varying intensity.

Turkey and Argentina have been amongst the hardest hit, but others – including India – are also feeling the heat. The Indian rupee has lost almost 9% since the US dollar since March. This is more or less similar to other EM Asian currencies, but much less than for instance the Turkish lira, the Argentine peso, the South African rand or the Brazilian real.

Although India’s external vulnerabilities have risen, its fundamentals are overall stronger than for instance Turkey and Argentina. Its growth (potential) is much higher and its external and public debt ratios are much lower, while India’s foreign exchange reserves still provide ample cover of imports and short-term external debt. Therefore, we do not think that India will face similar problems as Turkey or Argentina.

In conclusion Arjen says, India has not been immune to the market turmoil affecting EMs. Higher oil prices have driven external deficits up, there is some fiscal slippage in the run-up to the 2019 elections and many structural challenges remain including in infrastructure development and strengthening the banking system.

That said, from a fundamental macro perspective, the country is in much better shape than Turkey or Argentina. Hence, we do not expect India to face similar amounts of stress. Foreign reserves still comfortable, external and public debt ratios manageable!

“On the fiscal front, we expect the government to continue with its approach of gradual consolidation and reducing the budget deficit below 3.5% of GDP, although progress has stalled partly due to higher than expected oil prices and the rise in government bond yields stemming from the latest EM market turmoil. That said, the public debt ratio is on a downward trend reflecting India’s high growth rates, and is expected to fall to below 50% of GDP this year!”