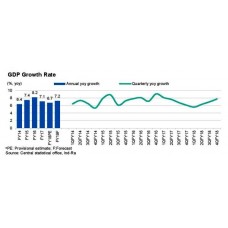

GDP Growth Revised Down to 7.2% by Ind-Ra

Mid-year FY19 Outlook Report by Analysts, Sunil Kumar Sinha, Devendra Kumar Pant, Bansi Madhavani & Amit Jain says Inflation, NPAs, Currency& Protectionism like factors are Major Headwinds!

India Ratings and Research (Ind-Ra) has revised down its FY19 gross domestic product (GDP) growth to 7.2% from its earlier forecast of 7.4%. The key reason for this is the upward revision in the estimation of inflation for FY19 due to (i) increasing crude oil prices and (ii) the government’s decision to fix the minimum support prices of all kharif crops at 1.5x of the production cost (A2+FL).

Ind-Ra believes the other headwinds lurking on the horizon are (i) rising trade protectionism (ii) depreciating rupee and (iii) no visible signs of the abatement of the non-performing assets of the banking sector.

Furthermore, it is taking a tad longer than expected to resolve cases under the Insolvency and Bankruptcy Code. This simply means ‘bringing the stuck capital back into the production process to enhance the productivity of capital’ will be a long drawn-out affair.

Consumption Steady, but Investment Remains a Concern says the report. Ind-Ra expects private final consumption expenditure to grow 7.6% in FY19 (as against its earlier forecast of 7.8%) compared to 6.6% in FY18.

Investment expenditure as measured by gross fixed capital formation (GFCF) though is unlikely to significantly improve over FY18; it is expected to grow at 8.0% in FY19. Though the average growth witnessed in GFCF during FY17-FY18 at 8.9% is quite healthy compared to the average GFCF growth of 3.1% during FY14-FY16, this was primarily driven by government capex as incremental private corporate capex has yet to revive.

Despite a likely normal rainfall in 2018, Ind-Ra expects average retail and wholesale inflation in FY19 to come in at 4.6% and 4.1%, respectively, as against 4.3% and 3.4% forecasted earlier. For Interest Rate the report says, Party Over! In response to the rising inflation, the RBI in its second and third Bi-monthly Monetary Policy Statement for FY19 increased the repo rate by a cumulative 50bp.

The RBI now expects the CPI inflation for 2HFY19 to be 4.8%, 10bp higher than its earlier projection. However by continuing to keep the monetary policy stance neutral, it has kept the window open to move the policy rate in either direction depending on the data outcome. With two back-to-back 25bp rate hikes, Ind-Ra believes there would not be any more hikes in FY19.

Current Account Deficit (CAD) to Widen; but Remain Manageable, Ind-Ra expects CAD to widen to USD71.1 billion (2.6% of the GDP) in FY19 from USD48.7 billion in FY18 (1.9% of GDP). The global economic upswing that began around mid-2016 has become broader and stronger. The International Monetary Fund expects global growth to come in at 3.9% in 2018.

Although both exports and imports are expected to record double-digit growth in FY19, the trade deficit may expand due to higher growth of imports than exports. This coupled with lower growth in invisibles in FY19 than in FY18 will lead to a higher CAD in FY19.