NEWS

Financial support to private banks and NBFCs

There

is no proposal currently under consideration of the Government to capitalise

private banks. This was stated by Shri Anurag Singh Thakur, Union Minister of

State for Finance & Corporate Affairs, in a written reply to a question in

Rajya Sabha.

He

further stated that capital infusion provision of Rs. 10,000 crore in India

Infrastructure Finance Company Limited (IIFCL) and Rs. 200 crore in Industrial

Finance Corporation of India Limited (IFCIL) is part of the Union Budget

proposals for the financial year 2020-21.

13th IIJS Signature opens door with 7th IGJME

Furthering India’s jewellery legacy! The Gem & Jewellery Export Promotion Council (GJEPC) presented the global trade with two wonderful opportunities to commence the Year’s buying season with the 13th edition of IIJS Signature and the 7th edition of India Gem & Jewellery Machinery Expo (IGJME) from 13-16 February 2020 at the Bombay Exhibition Centre, Goregaon, Mumbai, spanning an area of over 45,000 sq mts.

Mr.

Subhash Desai, Hon. Minister for Industries & Mining, Maharashtra State,

inaugurated the IIJS Signature along with Mr. Pramod Kumar Agrawal (Chairman,

GJEPC); Mr. Colin Shah (Vice Chairman, GJEPC), Mr. Mansukh Kothari (Co-Convener

Exhibitions and COA Member, GJEPC), Mr. Kirit Bhansali (Co-Convener Exhibitions

& COA-Diamond Panel, GJEPC), Mr. Sabyasachi Ray (Executive Director,

GJEPC), Mr. Shailesh Sangani (Member, National Exhibitions Sub-Committee,

GJEPC), Mr. Russell Mehta (former VC and Advisor to Chairman, GJEPC) and Mr. Ashok Gajera (Regional Chairman, GJEPC)

amongst others.

27 Winners announced at Artisan Awards 2020!

The Artisan Awards 2020 presented 27

winners!

Legendary

British designer Stephen Webster graces

The

Artisan Jewellery Design Awards 2020 an initiative of GJEPC

The

theme for the 3rd edition was

Architectural

Gems to target 2021 buying season!

Gem Diamonds 4Q revenue shots up by 41%

Gem

provides the following Trading Update detailing the Group's operational and

sales performance from 1 October 2019 to 31 December 2019 (Q4 2019). Highlights

are, 1: Revenue for the period was improved by 41% to US$51.3 million in 4Q

over the Q3 2019 of US$36.3 million at Gem Diamonds. 2: Average price achieved

for the Period increased by 21% to US$1 713 per carat (Q3 2019: US$1 417 per

carat).

3:

Carats sold during the Period increased by 17% to 29 945 (Q3 2019: 25 631), 4: Average

price achieved further improved to US$1 753 per carat for the first tender of

2020. 5: On 3 February 2020, recoveries of three exceptional 183, 89 and 70

carat diamonds were made and will be sold in March 2020.

Artisanal miner incursion at Montepuez

The

Company announces that the Maninge Nice 3 mining pit belonging to Montepuez

Ruby Mining Limitada (MRM) has experienced a coordinated incursion by

approximately 800 artisanal miners, vastly outnumbering the MRM security

personnel and Mozambican police present at that location at the time.

These

artisanal miners were seeking ruby-bearing gravels and, despite repeated

warnings from MRM personnel, commenced undercutting the outer edge of the

mining pit. This led to several ground collapse incidents in which 11 artisanal

miners died. MRM personnel provided humanitarian assistance where possible.

Silver production to grow by 2% in 2020

The

Silver Institute believes that macroeconomic and geopolitical conditions will

remain broadly supportive for precious metals, encouraging investors to stay

net buyers of silver overall, a development that should lift silver prices

higher this year. Additionally, we see continued growth in physical silver

investment, and forecast silver’s use as an industrial metal will rise in 2020.

Uptick in GDP Growth Expected in 2H of 2019-20

The

Government says that based on first Advance Estimates, India’s GDP growth for

2019-20 would be recorded at 5 per cent. This suggests an uptick in GDP growth

in second half of 2019-20. The Union Minister for Finance and Corporate

Affairs, Smt Nirmala Sitharaman tabled the Economic Survey 2019-20 in

Parliament today, which states that the deceleration in GDP growth can be

understood within the framework of a slowing cycle of growth. The financial

sector has acted as a drag on the real sector.

The

Survey says that the uptick in second half of 2019-20 would be mainly due to

ten positive factors like picking up of NIFTY for the first time this year, an

upbeat secondary market, higher FDI flows, build-up of demand pressure,

positive outlook for rural consumption, rebound of industrial activity, steady

improvement in manufacturing, growth in merchandize exports, higher build-up of

foreign exchange reserves and positive growth rate of GST revenue collection.

DITP Confirms Readiness to Host BGJF

The

Department of International Trade Promotion (DITP), Ministry of Commerce, has

demonstrated its confidence in the potential of Thailand to become the World’s

Jewelry Hub while assigning Thai Trade Centers around the world to proactively

promote the export of gems and jewelry products and focus on penetrating new

markets and expanding online sales channels in existing markets. The DITP has

also announced its readiness to organize the Bangkok Gems & Jewelry Fair

this February to offer new opportunities for Thai entrepreneurs to meet

international buyers.

At

the “Afternoon Tea Talk: Exploring the Charm of Thai Jewelry to Promote the

World’s Jewelry Hub,” Mr. Somdet Susomboon, DITP Director-General, said that

Thailand’s gems and jewelry industry is an industry with high potential that

offers all gems and jewelry-related products from upstream to downstream.

Improved growth track in fiscal 2020

According to the report, BWR Drishtikone, liquidity boosting measures to accelerate rate transmission and boost credit demand Budget proposals and the RBI’s liquidity boosting measures, coupled with previously announced government measures, are expected to bring the domestic economy on an improved growth track in fiscal 2020. Signs of economic revival, such as improved IIP and eight core sector activities, already exist. Furthermore, the Manufacturing PMI showed substantial rebound, with the index reaching an eight-year high of 55.4% in January.

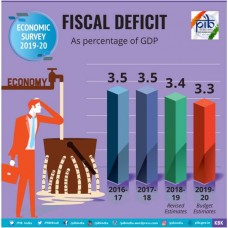

With a 3.5% fiscal deficit target for the next fiscal, the Finance Minister proposes to spend Rs 30.42 lakh crore in 2020-21, which is 12.7% higher than the revised estimate of 2019-20. On the revenue front, out of the estimated Rs 22.46 lakh crore, the government expects to collect 9% of its receipts through disinvestments (Rs 2,05,000 crore) from the sale of a large stake in LIC.

China revenue dips to over three decade low

China’s

fiscal revenue grew at the slowest pace since 1987 last year amid slowing

economic growth and big tax and fee cuts, official data showed on Monday,

reported CER.

Fiscal

revenue grew 3.8% to RMB 19 trillion ($2.7 trillion) in 2019, according to the

Ministry of Finance, missing the annual target of 5% growth. It was 2.4

percentage points lower than the revenue growth for 2018 and the second

consecutive annual slowdown.