NEWS

Platinum demand drops by 8% in Q2 2018

According

to the World Platinum Investment Council (WPIC) 2018 Q2 Platinum Market Review,

global platinum demand contracted by 8% year-on-year to 1,780 koz in the second

quarter this year. The largest decline was seen in investment demand which

swung from positive in Q2’17 (+100 koz) to negative in Q2’18 (-5 koz).

As

outflows from ETFs more than outweighed solid bar and coin demand, Automotive

demand fell year-on-year (-40 koz), while jewellery demand was unchanged and

industrial demand improved (+30 koz). Total platinum supply increased

marginally to 2,120 koz, as total mining supply grew by 1% (+10 koz) and

platinum recycling was flat year-on-year. With demand weakening and supply

little changed, the market had a surplus of 340 koz.

Outflows in gold ETFs continued!

Holdings

in global gold-backed ETFs and similar products fell by 40t to 2,353t in August

– the third consecutive month – pushing assets under management (US$ AUM) down

3% relative to July. Funds listed in China had net gains as investors hedged

trade risks and currency weakness. Flows in Europe were mostly flat. Global

outflows were led by North American funds which lost US$1.65bn.

Recent

reports of COMEX futures show extreme short positioning as gold’s pullback

generated additional selling pressure from money managers. But such negative

positioning, however, has historically preceded rallies in the price of gold,

as we discussed in detail in our recent note Gold recoils amid selloff but may

rebound.

Looking

at Regional fund flows, North American funds saw outflows of 44t (US$1.65bn,

3.6% AUM), Holdings in European funds grew by 4t (US$167mn, 0.4%), Funds listed

in Asia increased by 2t (US$24mn, 0.7%) & other regions saw a reduction in

holdings of 2t (US$50mn, 3.9%).

GIA India Shares Knowledge on Diamonds!

GIA

India organised the seminar, Diamonds – Are They Forever?, to help customers of

Shree Radhey Diamond in Anand, Gujarat, build knowledge and consumer

confidence. More than 50 diamond connoisseurs and buyers of diamond jewellery

attended the seminar in the August.

GIA

representative shared insights on the famous 4Cs of diamond quality – Color,

Clarity, Cut and Carat Weight – and how to care for and clean diamonds. The

seminar also helped potential consumers understand the importance of

independent diamond grading reports and a jeweller’s responsibility to sell

with disclosure.

FCC approves OreCorp to hold NMCL

Further

to the announcements made in July 2018, the Tanzanian Fair Competition

Commission (FCC) has now granted its approval for OreCorp Tanzania Limited

(OreCorp Tanzania) to increase its interest in Nyanzaga Mining Company Limited

(NMCL) to 51%.

This

move remains subject to: (i) the approval of the newly established Mining

Commission, the application for which was lodged at the same time as the

application for FCC approval; and (ii) the future payment of US$3 million to

the Acacia Group.

Reliance opens third Showroom in Jharkhand

Reliance

Jewels, India’s one of leading fine jewellery brands, launched its flagship

showroom in Ranchi at Mahatma Gandhi Main Road, opposite Gurudwara. As Jharkhand, a state with immense natural

resources races towards being the new business destination in eastern India,

Reliance Jewels is glad to be part of its journey.

Reliance

Jewels’ Ranchi showroom is the third showroom in Jharkhand after Jamshedpur

& Dhanbad.

Reliance

Jewels Ranchi showroom was today inaugurated by Shri Parimal Nathwani, Member

of Parliament (Rajya Sabha) from Jharkhand and Group President (Corporate

Affairs) of Reliance Industries Limited. On this occasion he stated “I am happy

to bring the best of the brands and experience to Ranchi, the state capital of

my Karmabhoomi, as we pave way for a better tomorrow.

World mintage of only 1piece!

The

Perth Mint is proud to present Discovery – a unique masterpiece with a world

mintage of only 1piece of coin. This extraordinary one-of-a-kind collectable

celebrates the discoveries in Australia of two of the world’s most treasured

natural riches, gold and pink diamonds.

The

stories of destiny and fortune are recreated through The Perth Mint’s

exceptional artistry and meticulously struck in 2kg of pure gold. Four

exceptional Argyle pink diamonds, including two exclusive stones weighing 1.02

and 0.88 carats, accentuate the detailed representation of how gold and

diamonds were discovered in the vast Australian outback.

Debt to Flow in from IBC

INR4.2 trillion Debts to Flow in From IBC Resolutions by 2019!

Mahaveer

Shankarlal, Associate Director & Jinesh Rajpara, Analyst India Ratings and

Research (Ind-Ra) believes around 45% of total bad loans of INR10.2 trillion

pertaining to the top 500 debt heavy corporates is likely to be resolved by the

end of 2018 under the Insolvency and Bankruptcy Code (IBC) Act, while the balance

is to be resolved largely during 2019.

Furthermore,

the agency expects INR4.2 trillion of the total stressed debt to become

sustainable as the outcome of the resolution process by the end of 2019. For

analysis, the bad loans include total borrowings of entities within the top 500

borrower universe as at March 2017, with either a credit rating of ‘C’ or ‘D’.

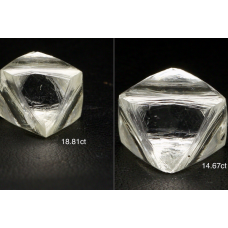

Alrosa to present the purple-pink diamond in HK

Alrosa,

the world’s largest diamond producer by output in carats, will hold the first

of its kind True Colour auction of coloured polished diamonds. It will be first

presented during Hong Kong Gem & Jewelry Fair in September, 2018.

The

collection includes 250 polished diamonds of various shapes and colours -

purple, pink, orange and vivid-yellow stones with GIA-certificates, some of

them of very rare shades. That will be the first time when Alrosa represents

its large coloured diamonds in such quantity.

Stornoway achieved underground production

Stornoway

Diamond Corporation has achieved sustained underground mine production at the

Renard Diamond Mine at or above the mine’s design capacity. This marks the

completion of the production ramp-up of the underground mine.

Over

a 20-day period, ore mucked and trucked to surface averaged 6,039 tonnes per

day against a budgeted design capacity of 6,000 tonnes per day. Ore production

is now being sourced from 16 active draw-points developed on 4 mining panels at

the 290m level of the Renard 2 kimberlite.

Endeavour to sale Tabakoto Mine

According

to the Endeavour Mining announcement, it has entered into a binding sale

agreement for its interest in the non-core Tabakoto mine to Algom Resources

Limited, for a total cash consideration of US$60 million. The consideration is

payable upon closing of the transaction which is expected to occur during the

fourth quarter of 2018.

Sébastien

de Montessus, President & CEO of Endeavour Mining, stated: "We are

pleased to continue to pursue our portfolio management strategy through the

sale of our non-core Tabakoto mine. This will increase our overall portfolio

quality and allow management to focus on high cash generating assets with low

AISC and long mine lives.”