NEWS

Jewellery designs to ramp on LFW with DPA

Lakmé

Fashion Week (LFW), India’s biggest fashion stage, in collaboration with the

Diamond Producers Association (DPA), has once again announced an enthralling

opportunity for the nation’s budding diamond jewellery design talent.

The

second edition of ‘The Real Cut’ is a platform for aspiring diamond jewellery

designers to collaborate with the best of contemporary fashion, giving winners a

once-in-a-lifetime opportunity to showcase their designs along with leading

fashion labels at the much-awaited LFW 2019 Winter Festive.

This

collaboration underscores the fact that diamonds only enhance the beauty of

couture with their timelessness. Owing to the success of the last edition of

‘The Real Cut’, the latest LFW edition takes this unique partnership a notch

higher.

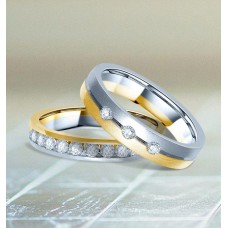

Zoe by Emerald unveiled 1st look of Platinum Jewellery with Swarovski Zirconia

Emerald

Jewel Industry launched its new brand Zoe- platinum jewellery with Swarovski

Zirconia at their dealer’s meet event in Coimbatore on 4th July. The launch was

graced by Ms. Michelle Shetty- face of ZOE, Mr. K Srinivasan & his entire

family, Mr. Rajendra Jain with Swarovski team, Emerald dealers and the entire

Emerald team.

An exclusive lounge & brochure of Zoe by

Emerald was created & showcasing a few exclusive pieces of Zoe collection

ranging from pendants to earrings and rings to bracelets. Special toned color

shades have used in platinum and 3D designs have created a completely fresh

look and style.

Regeneration of traditional industries

Scheme

of Fund for Upgradation and Regeneration of Traditional Industries (SFURTI)

aims to set up more Common Facility Centres for generating sustained employment

opportunities!

The

Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman said

that the Government aims to set up more Common Facility Centres (CFCs) under

the ‘Scheme of Fund for Upgradation and Regeneration of Traditional Industries’

(SFURTI). Presenting the Union Budget

2019-20 in the Lok Sabha, she said this will facilitate cluster based

development to make the traditional industries more productive, profitable and

capable for generating sustained employment opportunities. The focused sectors

are Bamboo, Honey and Khadi clusters. SFURTI envisions setting up of 100 new

clusters during 2019-20 to enable 50,000 artisans to join the economic value

chain.

NEIA to provide export cover

The

Central Government has an undertaking known as ECGC Limited under the control

of Department of Commerce, Ministry of Commerce & Industry, to support the

Indian exporters and bankers by providing cost-effective insurance and trade

related services against the risk of non-realisation of export proceeds.

Additionally,

the Government has set up the National Export Insurance Account (NEIA) operated

by ECGC to provide adequate credit insurance cover to protect long and medium term

exporters against both, political and commercial risks of the overseas country

and the buyer or & bank concerned. The NEIA trust also provides covers to

banks for Buyer’s Credit transactions, which facilitates foreign buyer to pay

for project exports from India.

GST further reforms in 2019!

Further

reforms of GST in current fiscal (2019-20) has an edge & some focussed

advantages,

1: Simplified Tax Structure: Reduction in cascading effect of taxes, transparent and has harmonisation of laws and procedures. 2: Easy Compliance: compliance burden has come down with one pan-India tax replacing multiple taxes and automated processes.

3: Promoting

Trade and Industry: Seamless flow of tax

credit. 4: Spurring Economic Growth: Creation of unified common national market.

Skill Development to benefit 10mn youth

The

Ministry of Skill Development and Entrepreneurship (MSDE) implements the PMKV Yojana

(2016 - 2020) to encourage and promote skill development for the youth

throughout the country. The scheme aims to benefit 10 million youth over the

period of four years (2016- 2020). The benefits under the scheme can be availed

by any anyone fulfilling the criteria specified in guidelines.

In

addition, a Special Project is being implemented at 40 locations in 13 states

namely Andhra Pradesh, Delhi, Haryana, Karnataka, Kerala, Madhya Pradesh,

Maharashtra, Odisha, Puducherry, Tamil Nadu, Telangana, Uttar Pradesh and West

Bengal by Muthoot Fincorp Pvt Ltd. 80% of the trained candidates will be placed

with Muthoot itself (Captive Placement). As per the details available so far

1679 candidates have been trained and 569 placed under project.

GJSCI Announces Anant Winners

Gem

& Jewellery Skill Council of India (GJSCI) in its endeavor to revive some

dying arts in our country aimed at promoting design development, product

innovation and diversification of India’s for heritage arts form viz. Hupari

Payal (Kolhapur), Tarakasi (Cuttack), Thewa (Rajasthan) & Gajra (Bhuj, Gujarat)

designed a contest around these arts.

The objective behind the whole concept was to promote these arts and

create some contemporary designs around it and help uplift the artisans to use

these designs and create more pieces of jewellery to meet the domestic as well

as international market.

The

selection for the winners was tough as they were rated on various parameters like

detail, concept & originality, ease to manufacture, sales potential &

creativity. After a stringent scrutiny by a panel of leading experts from the

gems & jewellery industry Shri Sanjay Kothari the Chairman of GJSCI along

with Mr Rajeev Garg, Executive Director & CEO, GJSCI invited renowned

celebrities from the gems & jewellery industry to be a part of this Panel

of Jury Members.

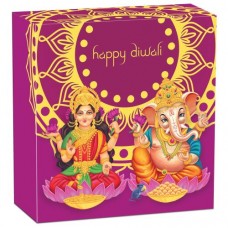

Diwali 2019 1oz Silver Medallion

The

ancient, festival of lights-Diwali is celebrated by millions around the world

in October or November each year depending on the cycle of the moon. Deities

honoured during this five-day period in particular are Lakshmi, the goddess of

wealth and prosperity, and Ganesha, the god of intellect and over comer of

obstacles.

An

outstanding keepsake to mark the occasion, this vividly coloured medallion

honours traditional depictions of the deities with a carefully considered

design.

GST processes further simplified

Further

simplification of the GST processes, increasing Special Additional Excise duty

and Road and Infrastructure Cess on petrol and diesel by one rupee each, hike

in Customs Duty on Gold and precious metals to 12.5% and imposing nominal basic

excise duty on tobacco products and crude are among the salient proposals

pertaining to the Indirect Taxes in the Union Budget 2019-20. It also provides

for exempting import of certain Defence Equipments from basic customs duty, reducing

customs duty on certain raw materials and capital goods, and rationalization of

export duty on raw and semi-finished leather.

GST:

Presenting

the Budget in Parliament, the Union Minister of Finance and Corporate Affairs,

Smt. Nirmala Sitharaman announced that GST processes are being further

simplified. The threshold exemption

limit for a supplier of goods is proposed to be enhanced from Rs. 20 lakhs to

an amount exceeding Rs. 40 lakhs.

Strengthening MSMEs, Lowering Corporate Tax

Make

in India, with particular emphasis on Micro, Small and Medium Enterprises, is

one of the major focus areas of the Union Budget this year. Delivering her

budget speech in Parliament today, Union Minister of Finance and Corporate

Affairs Smt. Nirmala Sitharaman announced various proposals aimed at

strengthening the sector.

For

ease of access to credit for MSMEs, Government has introduced scheme for

providing of loans upto Rs. 1 crore within 59 minutes through a dedicated

online portal. Under the Interest Subvention Scheme, Rs. 350 crore has been

allocated for FY 2019-20 for 2% interest subvention for all GST registered

MSMEs, on fresh or incremental loans.