NEWS

Gold ETFs net inflows added 154 tonnes

Gold

ETF inflows through May outpace records

For

any calendar year in only 5 months

Continuing

their growth streak, gold-backed ETFs (gold ETFs) added 154 tonnes (t) – net

inflows of US$8.5bn (+4.3%) across all regions in May, boosting global holdings

to a new all-time high of 3,510t.1 Year-to-date, inflows (623t, US$33.7bn) now

exceed the highest level of annual inflows (591t) seen in 2009.

Lundin Gold Resumes at Fruta Del Norte

Lundin

Gold steps up at first phases for restart of operations at Fruta Del Norte are

well underway. The Company has shipped

all of the concentrate and doré that had been stored at site since the

suspension of operations on March 22, 2020.

In addition, reagents, spare parts and other supplies that had been

accumulating at the port of Guayaquil are being transported to site.

On

May 15, 2020, Ecuador's national government issued COVID-19 protocols that set

out health and safety guidelines for the mining industry in order to enable

operations to restart. In addition, the

government established logistics corridors that facilitate transportation for

the mining industry.

2020 gold exploration program at Granada

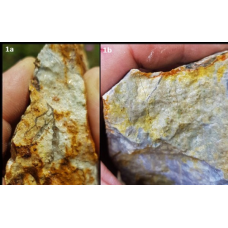

Granada

Gold provides an update of its 2020 plans and activities aimed at exploration

and bulk sampling. Diamond drilling aims to focus on the high-grade Vein

structure. To date, the structure has

been traced for 500 metres on surface. Completion of bulk sample of high-grade

Vein No. 1, targeting 30-50 tonnes mineralized material.

Historic

underground production between 1930 and 1935, from 2 shafts had an average

grade of 9.7 grams/tonne gold and 1.5 grams/tonne silver from 164,816 tonnes of

mineralized material primarily from Vein No.2 underground. A later, 1996 bulk

sample extracted a bulk sample of 22,095 tonnes from surface grading 3.46 g/t

gold from Vein 2.

New high grade gold discoveries

Pure

Gold Mining launches 2020/2021 exploration and resource growth program at its

100% owned PureGold Red Lake Mine in Red Lake, Ontario, Canada. Over 30,000

meters of diamond drilling, including both underground and surface drilling, is

planned to optimize the near term mine plan, expedite the growth of our mineral

resources and aggressively expand new high-grade discoveries.

“We

believe strongly in the organic growth potential of our PureGold Red Lake Mine

property. And we are confident that the mine plan outlined in our feasibility

study is scalable and has the potential to expand,” said Darin Labrenz,

President and CEO.

Velocity finds 14 new gold zones at Bulgaria

Velocity

Minerals has received results from 14 additional drill holes from its Obichnik

gold project, Bulgaria. Results include

the first drill test of the Sivri Tepe target, located approximately 400m to

the west of the established Durusu Tepe zone.

The Sivri Tepe discovery highlights the potential to significantly

expand the extent of, near-surface, high-grade mineralization at Obichnik. Additional drill holes are planned as

near-term follow-up.

DPA rebrands itself as Natural Diamond Council

A

new Consumer-facing identity and

Digital

platform called: Only Natural Diamonds!

The

world’s leading diamond producers launched the Natural Diamond Council (NDC),

formerly known as the Diamond Producers Association (DPA), in USA and Europe.

The NDC will promote the desirability of natural diamonds and support the

integrity of the natural diamond jewellery industry.

Diamond Markets Return Cautiously

Diamond

trading is starting to regain traction in Hong Kong with some demand from

China. Hong Kong is mostly open for business, but concerns are mounting about

renewed protests following new Chinese security laws. New York’s 47th Street

remains closed as other parts of the US slowly begin to open.

US

riots over police brutality are also creating concern. India is partially

active again, while bourses in Belgium and Israel are operating under health

and safety guidelines. Polished prices were stable in May amid minimal trading;

business was limited to online platforms. The RapNet Diamond Index for 1-carat

diamonds rose 0.2% during the month, but has dropped 8.3% since the beginning

of the year.

Liberty Gold to sales shares of Kinsley Mountain

Liberty

Gold announces the receipt of the Initial Option Payments (IOP) under the

definitive purchase option agreement for the sale of its 79.9% interest in the

Kinsley Mountain gold deposit, a Carlin-style gold deposit in eastern in Nevada

to Barrian Mining Corp.

Pursuant

to the terms of the Agreement, Liberty Gold has or will receive in total

consideration for its interest in Kinsley, an aggregate US$6,250,000 in cash

and shares plus a 9.9% interest in New Placer Dome. The consideration will be

paid in three stages over a two-year period.

Uncertainty abounds in predicting recovery

While

the reopening of businesses shut down by the coronavirus pandemic is a

significant step forward, it is too soon to say how quickly or smoothly the

nation’s economy will recover, National Retail Federation Chief Economist Jack

Kleinhenz said today.

“Is

it possible the worst of the coronavirus pandemic is behind us? Maybe, but we

are not out of the woods yet, and uncertainty abounds,” Kleinhenz said.

“Predicting what will happen is even more challenging than usual. While history

often helps guide us, previous downturns offer little guidance on what is

likely to unfold over the next six to 12 months. There is no user’s manual in

which government, businesses or consumers can find precise solutions for what

we are going through.”

NV Gold Enters Strategic Data Relationship!

NV

Gold Corporation has entered into a strategic data relationship with GoldSpot

Discoveries. “I am excited to build a technical relationship with GoldSpot to

fully explore, for the first time, our extensive geological databases in Nevada

utilizing their advanced, proprietary technology in combination with our

industry recognized technical team,” commented Peter A. Ball, President and CEO

of NV Gold.

“Gold

Spot’s team is clearly recognized as the leader in the industry to assist

companies fully evaluate and analyze their projects and/or data available,

highlighting prospective targets, and yielding opportunities for new

discoveries. With a robust gold market, a tight share structure, no debt, and

the recently oversubscribed private placement closed on May 26th, 2020, we are

excited for a busy 2020 exploration season ahead of us.”