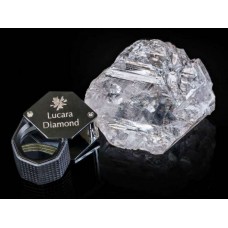

Lucara recovers 190 Specials diamonds!

As at March 31, 2020, the Company had cash and cash equivalents of $27.4 million, an increase of $16.2 million from December 31, 2019. The Company maintained draws totalling $19.0 million on the working capital facility from Q1 2020.

A balance of $31.0 million is available to be drawn for working capital, if required, subsequent to March 31, 2020. The Company begins the second quarter with a strong cash position and available liquidity. A strong operating environment prevailed at the Karowe Mine in Q1 and delivered results consistent with the 2020 plan and budget: 1: 0.64 million tonnes of ore processed resulting in 91,536 carats recovered, achieving a recovered grade of 14.3 carats per hundred tonnes.

190 Specials (+10.8 carats) were recovered from direct milling during the first quarter, representing 6.7% weight percentage of total direct milling recovered carats, in line with mine plan expectations! 8 diamonds were recovered greater than 100 carats in weight & In early February 2020, an unbroken 549 carat white diamond of exceptional purity was recovered from direct milling of ore sourced from the EM/PK(S) unit of the South Lobe. This diamond was not made available for sale in Q1.

Total revenue of $34.1 million was recognized in Q1 2020 (Q1 2019: $48.7 million) or $396 per carat (Q1 2019: $512 per carat) from the sale of 86,178 carats (Q1 2019: 95,053 carats). The Q1 2020 tender represents the smallest planned sale for the year and reflects a reduction in realized prices in the larger size classes compared to those achieved from the equivalent period in 2019.

The value of the rough diamonds transacted through the Clara platform in Q1 2020 was $3.0 million over six sales, which brings the total value transacted on the platform between December 2018 and March 2020 to $12.1 million.

A continued focus on operational discipline at Karowe has resulted in a strong operating margin of 49% year to date (Q1 2019: 67%) and adjusted EBITDA(1) year to date of $8.1 million (Q1 2019: $23.4 million). Operating expenses per carat sold totalled $201 per carat in the three months ended March 31, 2020, up from $169 per carat sold in the comparable period last year. Total carats sold were approximately 10% less by volume than the same quarter last year (Q1 2020: 86,178 carats sold; Q1 2019: 95,053 carats sold).

Eira Thomas, President & CEO commented: "I am extremely proud and heartened by the efforts of our employees, contractors, partner communities and governments who have all come together and taken swift action in support of Lucara's COVID-19 crisis management strategy, designed to keep our people safe and our mine operating.

Declared an essential service by the government on April 2, Karowe continues to operate safely and at full production. Demand for our product, however, continues to be weak and Lucara is necessarily focused on cost management and capital discipline through this period of uncertainty. To this end, Lucara's capital spending program for 2020 is now being re-scoped to focus on critical path elements, largely in support of our ongoing, underground expansion program.

As a reminder, Lucara entered this crisis with a strong balance sheet and no debt. As a further positive development, Lucara's $50 million credit facility with the Bank of Nova Scotia was recently renewed for another year, providing the Company with additional flexibility and liquidity to continue to effectively manage our business through 2020.

Though our near-term outlook on diamond prices remains uncertain, global rough diamond production curtailments combined with early indications of polished diamond demand recovery in Asia provide some optimism that demand will improve in the latter half of the year."